Place the events in sequence to describe how crowding-out happens. This is a crucial concept in economics that examines the impact of government borrowing and monetary policy on private investment. Understanding this sequence is essential for policymakers and economists seeking to foster economic growth and maintain financial stability.

Crowding-out occurs when government borrowing or restrictive monetary policy leads to higher interest rates, which in turn reduces private investment and consumer spending. This can have significant implications for long-term economic growth and productivity.

Fiscal Policy Impacts on Private Investment: Place The Events In Sequence To Describe How Crowding-out Happens.

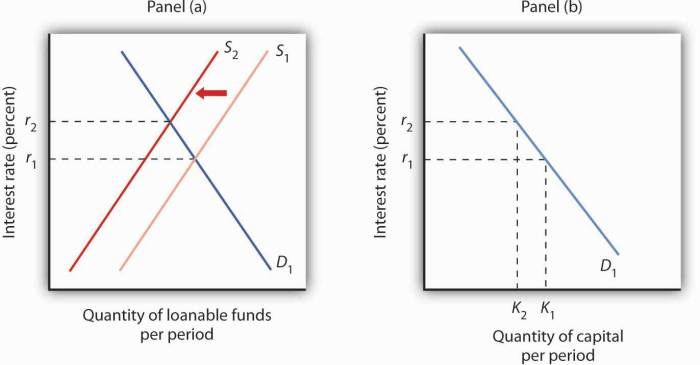

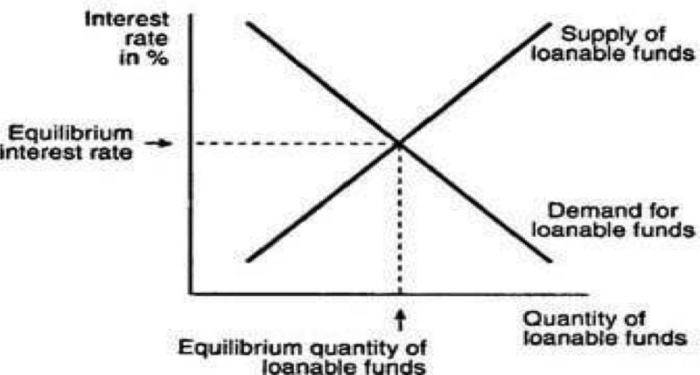

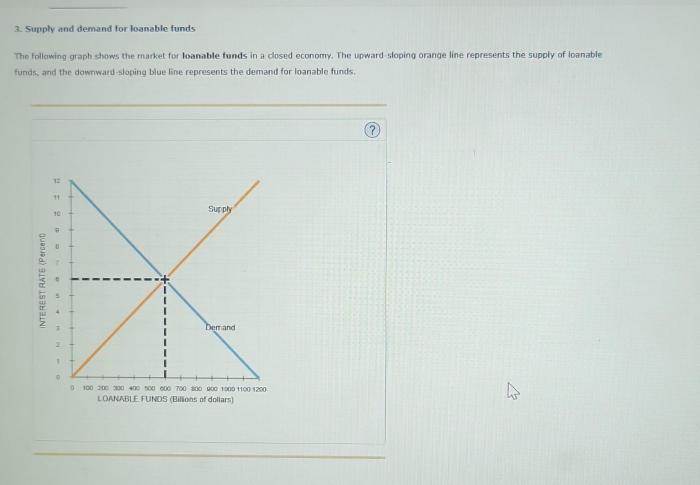

Fiscal policy, through government borrowing, can impact interest rates. When the government borrows heavily, it increases the demand for loanable funds, which drives up interest rates. Higher interest rates make it more expensive for businesses to borrow money for investment, reducing private investment and potentially crowding out private investment.

Examples of Crowding-Out, Place the events in sequence to describe how crowding-out happens.

- In the United States during the 1980s, high government borrowing to finance tax cuts and increased military spending led to higher interest rates, crowding out private investment and slowing economic growth.

- In Japan during the 1990s, government borrowing to stimulate the economy resulted in higher interest rates, which discouraged private investment and contributed to the country’s “lost decade” of economic stagnation.

Monetary Policy and Crowding-Out

Monetary policy, through actions such as raising interest rates to control inflation, can also lead to crowding-out. Restrictive monetary policy increases the cost of borrowing, making it more expensive for businesses to invest and for consumers to borrow. This reduced spending can crowd out private investment and slow economic growth.

Impact of Higher Interest Rates

- Higher interest rates make it more expensive for businesses to finance new projects, leading to reduced investment and slower economic growth.

- Consumers may delay or reduce spending on big-ticket items, such as homes and cars, when interest rates rise, further reducing demand and potentially crowding out private investment.

Crowding-Out and Economic Growth

Crowding-out can have significant consequences for long-term economic growth. Reduced private investment can lead to lower productivity, reduced innovation, and slower economic growth. Countries that experience sustained crowding-out may face long-term economic stagnation.

Consequences of Crowding-Out

- Reduced private investment can lead to lower productivity, as businesses are unable to invest in new technologies and equipment.

- Innovation may be stifled as businesses have fewer resources to invest in research and development.

- Economic growth can slow down as reduced investment and innovation lead to lower output and productivity.

Government Spending and Crowding-Out

Government spending can also contribute to crowding-out. When the government spends heavily, it increases the demand for loanable funds, which can drive up interest rates. This can crowd out private investment, as businesses and individuals find it more expensive to borrow.

Types of Government Spending

- Government consumption spending:Direct spending on goods and services by the government, such as infrastructure projects and public sector salaries, can increase demand for loanable funds and lead to higher interest rates.

- Government transfer payments:Payments made by the government to individuals, such as social security and unemployment benefits, can also increase demand for loanable funds if they are not fully funded through taxation.

Structural Factors and Crowding-Out

Certain structural factors can influence the extent of crowding-out. These include financial development and market efficiency, which affect the availability of loanable funds and the cost of borrowing.

Impact of Structural Factors

- Financial development:A well-developed financial system can increase the supply of loanable funds, making it less likely that government borrowing will crowd out private investment.

- Market efficiency:Efficient financial markets can reduce the cost of borrowing, making it less likely that government borrowing will have a significant impact on private investment.

FAQ Corner

What is crowding-out?

Crowding-out occurs when government borrowing or restrictive monetary policy leads to higher interest rates, which reduces private investment and consumer spending.

What are the implications of crowding-out for economic growth?

Crowding-out can reduce private investment, which can lead to lower productivity, innovation, and economic growth.

What are some examples of structural factors that can influence crowding-out?

Structural factors that can influence crowding-out include financial development, market efficiency, and government policies.